Vietnam’s cashew industry has once again proven its resilience, with its first-quarter 2023 cashew exports soaring to 122 thousand tons valued at 708 million USD. This marks an impressive uptick of 16.6% in volume and 14.2% in value over the same period in 2022. Despite various challenges, Vietnam’s cashew industry continues to thrive, thanks to the country’s adept handling of the crisis and its consistent efforts to improve product quality and efficiency. With such promising figures, Vietnam is poised to further assert its position as a leading player in the global cashew market.

Vietnam Cashew Industry On The Way to Recovery

The Vietnamese cashew export market saw a steep decline in both volume and value in January 2023. However, things took a positive turn in February 2023, as there was rapid growth in the sector once again. According to data from the General Department of Customs, cashew kernel exports in Vietnam reached 34.3 thousand tons in February 2023, valued at $197.7 million. This marked a significant increase of 25.8% in volume and 26.9% in value compared to the previous month of January 2023. Furthermore, there was an impressive increase of 35.4% in volume and 31.2% in value compared to the same period in 2022.

=> Xem thêm: Vietnam Cashew Nuts Supplier and Exporter

By March 2023, Vietnam’s cashew exports had experienced a remarkable surge. In that month alone, 60,000 tons of cashew nut kernels were exported which were valued at $355 million. This marked an increase of 75% in volume and 79.5% in value over February 2023, and a significant increase of 50.4% in volume and 48.6% in value compared to the same period in 2022.

The first quarter of 2023 proved to be a promising one for product exports in Vietnam, particularly in the cashew nut sector. Cashew nut exports reached 122 thousand tons, valued at $708 million – an increase of 16.6% in volume and 14.2% in value compared to the previous year. These remarkable statistics showcase a thriving Vietnamese cashew export market that is well on its way to recovery in terms of volume and value.

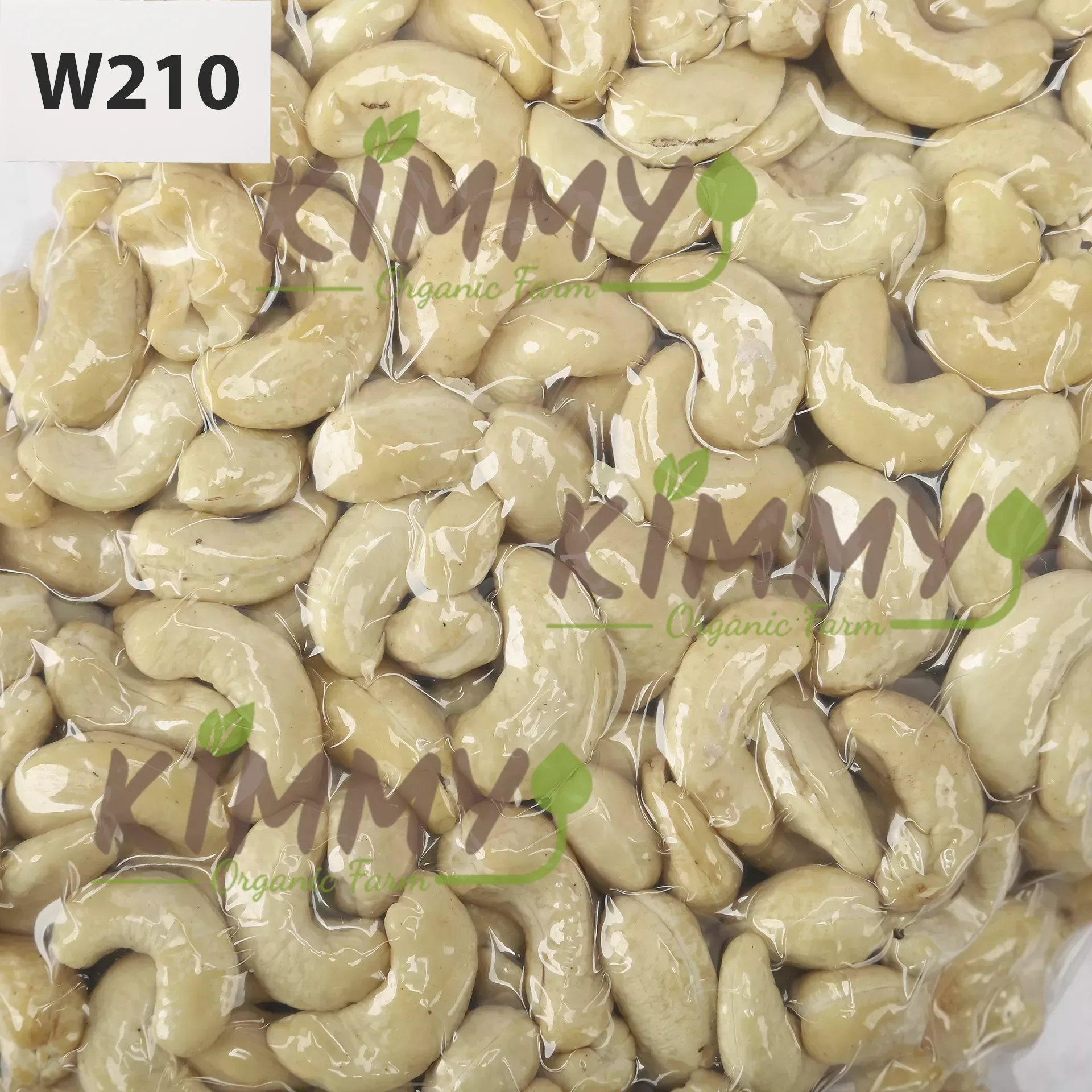

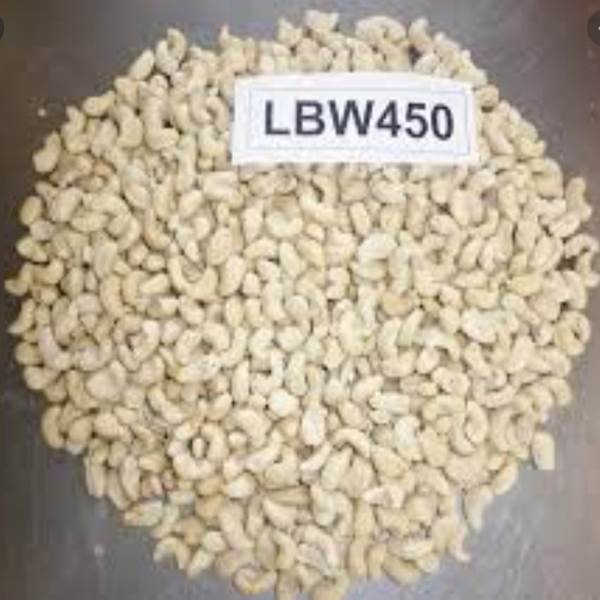

Vietnam Cashew Grade Based on AFI – Vietnam Cashew Exports – Kimmy Farm Vietnam

Vietnam’s Cashew Industry is Still Facing Challenges

The outlook for Vietnam’s cashew industry in 2023 presents a grim picture. According to Vinacas Chairman Pham Van Cong, the sector will continue to face numerous challenges, including sluggish consumer demand and stagnating prices. The global cashew supply chain, specifically in Vietnam, is encountering challenges resulting from exchange rate fluctuations, rising processing costs, and declining consumption levels. Moreover, the main cashew kernel consumer markets are experiencing inflation, exacerbating concerns about inventory levels. Despite these challenges, Vietnam’s cashew industry has set its sights on cashew exports in 2023, with a “modest” target of $3.1 billion. This amount will represent a marginal increase of $30 million compared to 2022. The industry’s approach to this objective will be centered on the policy of “reducing quantity while increasing quality.”

The Vice President of VINACAS, Mr. Tran Van Hiep has highlighted that geopolitical disputes, such as the Russia-Ukraine conflict, are having a significant impact on the export and consumption of Vietnam’s cashew nuts. In 2021, Russia ranked as the 11th largest market for Vietnam’s cashew kernels, with an export value of nearly $62 million USD. However, since Russia’s exclusion from the SWIFT payment system, Vietnamese cashew nut exporters have encountered payment difficulties, particularly affecting their exports to Russian markets.

Furthermore, the inflation currently affecting the United States and Europe is spreading worldwide, leading to price increases in all goods and services. People are now allocating more funds towards essential needs, which has resulted in lower demand for non-essential items, such as cashew nuts. Consequently, the price of cashew nuts is difficult to increase in the current market conditions.

Vietnam’s cashew nut industry remains a vital aspect of the nation’s economy, with the country being the largest exporter of cashew nuts globally. However, recent market disruptions have impacted the industry significantly, and the industry leaders are calling for a more comprehensive approach to address the issue. The industry has been hit hard by geopolitical disputes and market fluctuations stemming from external factors such as inflation. Although these challenges pose significant obstacles, the industry remains optimistic that the situation can be addressed through effective collaboration between market stakeholders and policymakers.

Vietnamese Worker Harvest cashew apples at Binh Phuoc Vietnam

Vietnam Cashew Industry Miss Export Target in 2022

The Vietnam Cashew Association (VINACAS) recently conducted a conference to evaluate the activities of 2022 and discuss their plans for the upcoming year. According to VINACAS’s report, the cashew industry in Vietnam witnessed consistent growth in exports for 10 years, starting from 2011 until 2021. However, the year 2022 marked the end of this growth streak, and the country failed to achieve its cashew export target of $3.2 billion, despite reducing it by $600 million. The nation only managed to earn $3.07 billion through cashew exports.

=> Read more: Where Are Cashew Nut Trees Grown In Vietnam?

A brand specializing in the production and export of agricultural products in Vietnam. We have a black soldier fly farm in Tay Ninh and a cashew growing area in Binh Phuoc. The main export products of the company are: cashew nuts, cashew nut kernels, black soldier fly, frozen seafood, shrimp, prawns, catfish… from Vietnam.