In 2022, Vietnam reduced the export target of cashew nuts from $ 3.8 billion to $ 3.2 billion, but in the end, the Vietnamese cashew industry only finished at $ 3.07 billion. In 2023, the growth forecast is still not positive.

Vietnam Cashew Industry Miss Export Target in 2022

The Vietnam Cashew Association (VINACAS) has recently held a conference to evaluate the activities of 2022 and provide direction for 2023. According to VINACAS’s report, 2022 marked the end of a 10-year period of steady export growth for Vietnam’s cashew industry, spanning from 2011 to 2021. Regrettably, Vietnam failed to achieve its cashew export target for 2022, only raking in $3.07 billion, missing the $3.2 billion goal, even after adjusting it downwards by around $600 million from the initial target. The US, EU, and China remained the most outstanding markets for Vietnam’s cashew kernels.

=> Read more: Where Are Cashew Nut Trees Grown In Vietnam?

Vietnamese Worker Harvest cashew apples at Binh Phuoc Vietnam

Fortunately, there’s been great support for processed cashew products for domestic consumption and export volume, accounting for approximately 5% of the entire Vietnam industry’s total processed cashew kernel output recorded in 2022. However, there are still continuing challenges for Vietnam’s cashew nut exports in 2023. The trend of reduced spending on non-essential food items, due to inflation and the economic recession, is expected to persist, resulting in sluggish consumption and challenging price increases. The situation for cashew exports in the period of 2022 – 2023 looks set to pose greater difficulties than the 2019-2021 period.

Roasted Cashew nuts with Testa are the most popular products in Vietnam’s local market – Kimmy Farm Vietnam

Challenges Persist for Vietnam Cashew Nut Exports 2023

Vietnam’s cashew nut industry faces significant challenges as it moves into 2023. According to the Vietnam Cashew Association (VINACAS), global production and supply chains will continue to encounter major hurdles due to ongoing economic and political turmoil, inflation, recession, tightening credit policies, fluctuating USD/VND exchange rates, declining consumer demand, rising processing costs, and stagnating production.

As a result, the export outlook for 2023 is uncertain, with VINACAS recommending a modest adjustment of export revenue targets for the year to approximately $3.1 billion, a slight increase of $30 million from 2022 figures. Despite these challenges, Vietnam remains a leading producer of cashew nuts on the world stage. The country’s cashew exports to the United States, India, and China contribute significantly to its agricultural exports and economic growth.

To overcome the industry’s challenges, Vietnamese cashew exporters will have to adopt innovative strategies to increase efficiency and reduce costs while maintaining the high quality of cashew products. Improved market access, greater investment in research and development, and stronger collaboration between industry stakeholders are also crucial in securing the future of Vietnam’s cashew nut exports.

=> Read More: How To Check Quality Of Cashew Nut Kernels?

Vietnamese cashew exporters will have to adopt innovative strategies to increase efficiency and reduce costs while maintaining the high quality of cashew products.

Source: Synthesize multiple sources

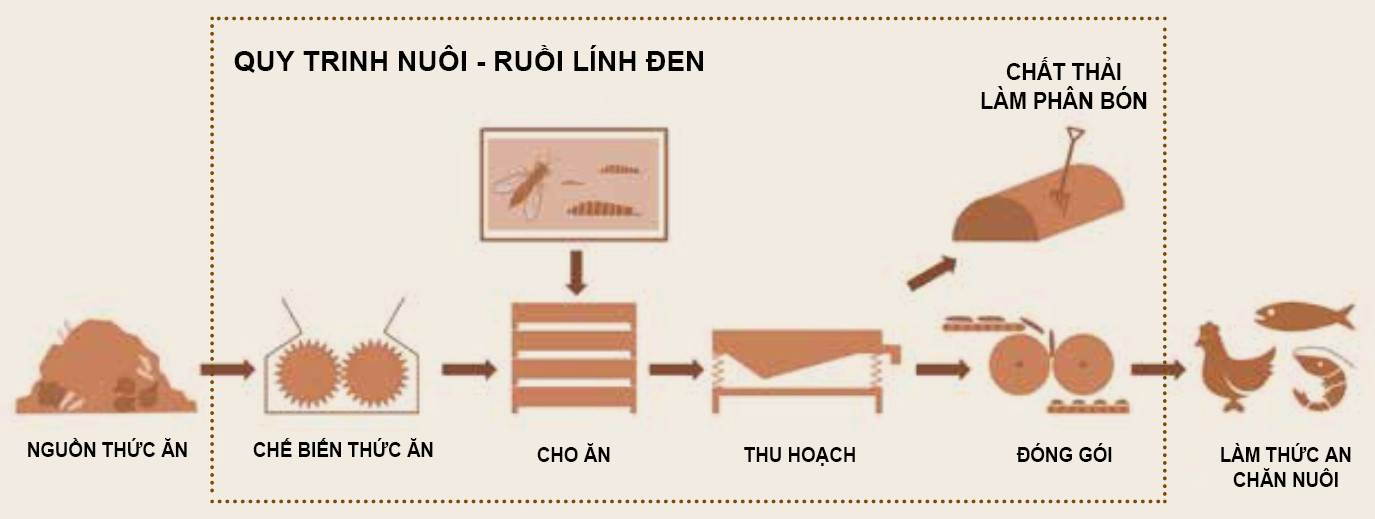

A brand specializing in the production and export of agricultural products in Vietnam. We have a black soldier fly farm in Tay Ninh and a cashew growing area in Binh Phuoc. The main export products of the company are: cashew nuts, cashew nut kernels, black soldier fly, frozen seafood, shrimp, prawns, catfish… from Vietnam.