In 2022, Nigeria celebrated an impressive achievement in the non-oil sector by exporting a whopping 315,677 tons of raw cashew nuts, valued at $252 million. This considerable feat accounted for 5.24% of the country’s non-oil portfolio. With this significant development, Nigeria solidifies its position as one of the leading exporters of cashew nuts worldwide. The country’s dedication to the production and distribution of cashew nuts continues to serve as a significant source of revenue, contributing significantly to the Nigerian economy.

Nigeria Exports 315,677 Tons Of RCN In 2022

The Nigeria Export Promotion Council (NEPC) has recently disclosed that Nigeria has successfully exported a whopping 315,677 tons of raw cashews worth $252 million in 2022. This contributes significantly to the total non-oil export earnings of the country, with the cashew nut sector alone accounting for 5% of the revenue. Dr. Ezra Yakusak, the Executive Director of the NEPC, made this announcement during the launch of the Organic Cashew Certification Program in Abuja, Nigeria.

Nigeria ranks fourth as the largest producer of raw cashew nuts in Africa, with approximately 19 countries specializing in cashew cultivation. Despite the massive cashew production potential of the country, it has not fully maximized it, according to Dr Yakusak. The export of raw cashew is a significant area that needs more attention in Nigeria.

Nigeria successfully exported a whopping 315,677 tons of raw cashews worth $252 million USD in 2022

Raw Cashew Nuts are one of Nigeria’s prominent non-petroleum export products, according to statistical data from the Nigerian Government’s Non-Petroleum Performance Report for 2022 released in April 2023. It is the fifth-highest export product, justifying its importance and showing its potential as a primary export commodity for the country.

Nigeria is endowed with vast arable land that is suitable for cashew and other agricultural productions. The production and exportation of raw cashew nuts have the potential to boost foreign exchange earnings, increase employment opportunities, and stimulate economic growth for the country. The cashew nut sector has experienced a tremendous boost in recent years, thanks to investments in processing and value-addition activities. However, Nigeria should focus on increasing the capacity of the local farmers to compete better in the international cashew market.

The Nigerian Cashew Industry Still Faces Many Challenges

The Nigerian cashew industry has the potential to be a major player in the global market, but unfortunately, it still faces many challenges. According to Dr. Ezra Yakusak, the executive director of NEPC, Nigeria’s cashew nut export trade is struggling due to a lack of compliance with safety standards, traceability issues, low yield per orchard, poor care techniques, and old trees. These problems have caused many of our cashew exports to be unprocessed and raw, limiting the value of the industry.

Lack of compliance with safety standards

One of the biggest obstacles facing the industry is the lack of compliance with safety standards. It is essential to ensure that cashews meet internationally recognized safety standards before they can be exported. This means enforcing strict quality control measures, improving hygiene practices, and educating farmers and traders about the importance of safety protocols.

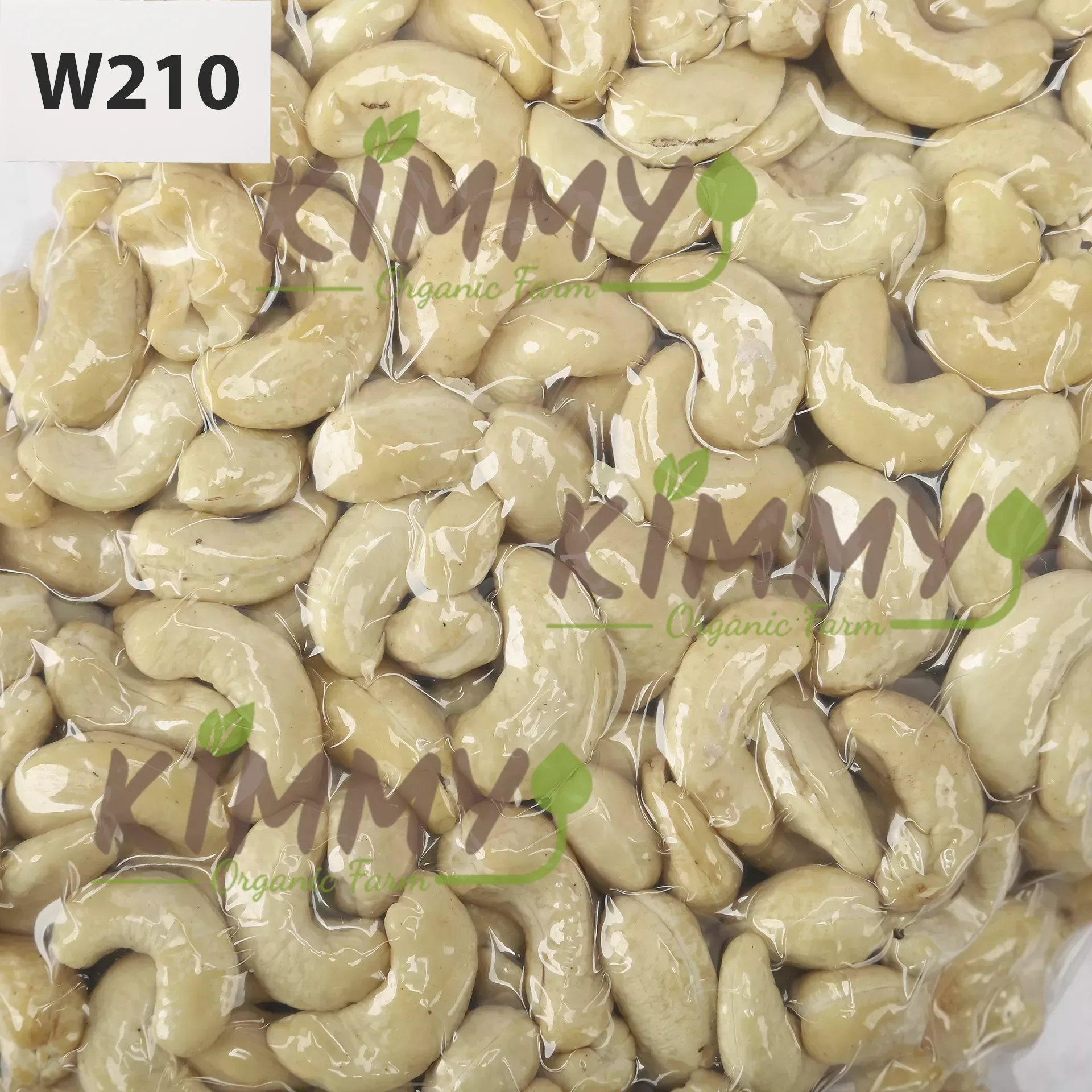

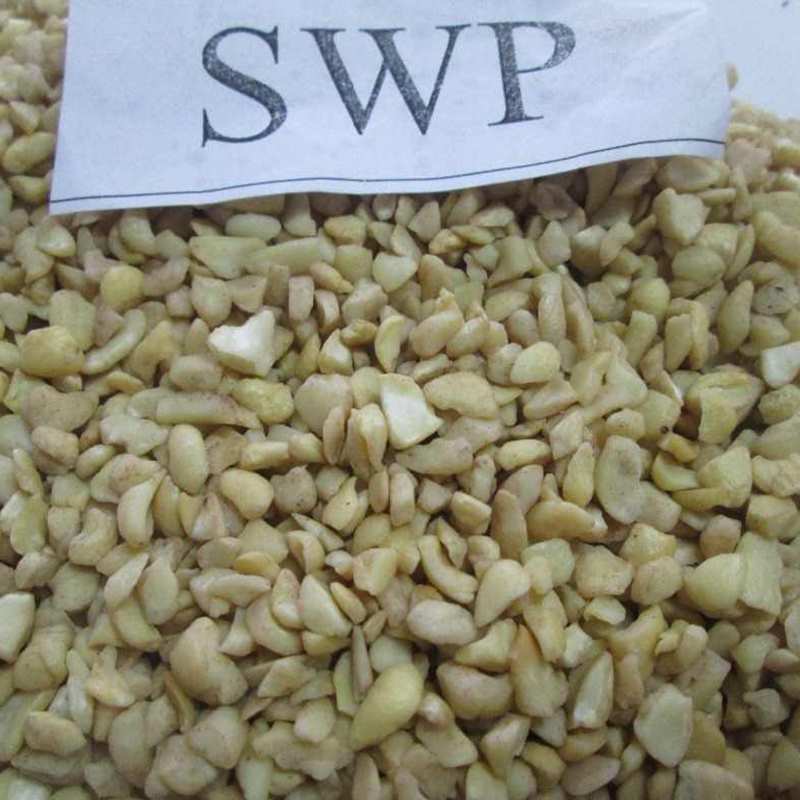

=> Read More: The AFI Standard of Cashew Nuts: Different Grades Cashew Kernels

Lack of traceability

Another issue is the lack of traceability. Without proper documentation and tracking systems, it is difficult to ensure the quality, safety, and authenticity of cashews originating from Nigeria. This can lead to consumer mistrust and rejection of the product in international markets.

Low yield per orchard

Low yield per orchard is another significant challenge. Many cashew farmers struggle to produce high-quality cashews due to poor care techniques and old trees. Poor care techniques can result in damaged and low-quality cashews, which reduce the value of the crop. Old trees also produce fewer and lower-quality cashews, so it is crucial to invest in replanting programs and encourage the adoption of modern farming methods.

The Nigerian Cashew Industry can overcome these challenges by investing in modernization, training, and education. There is an urgent need for farmers, traders, and other stakeholders to work together to improve quality control, traceability, and productivity. This will help to increase the value of the industry and position Nigerian cashews as a premium product in the global market.

Processed Cashews From Nigeria Only 16% of Total RCN

The export of processed cashews from Nigeria is currently low, accounting for only 16% of the total volume. This is in contrast to the high export of raw cashews, which are predominantly sold without organic certification. Due to these concerns, Ezra Yakusak has highlighted the need for collaboration and planning to address the challenges facing the Nigerian cashew industry. To help with this, PRO-Cashew has funded a five-year project through CNFA which aims to promote the organic certification of cashews in Nigeria. This initiative is timely and very welcome. It is clear that there is a need for increased focus on processed cashews in the Nigerian cashew industry. While raw cashews have a place in the market, it is vital to promote the benefits of processed cashews, such as higher-value exports and increased demand for organic certification. We hope that this partnership will help to boost the market for processed cashews in Nigeria and lead to sustainable growth in the industry.

The export of processed cashews from Nigeria is currently low, accounting for only 16% of the total volume of RCN.

A brand specializing in the production and export of agricultural products in Vietnam. We have a black soldier fly farm in Tay Ninh and a cashew growing area in Binh Phuoc. The main export products of the company are: cashew nuts, cashew nut kernels, black soldier fly, frozen seafood, shrimp, prawns, catfish… from Vietnam.